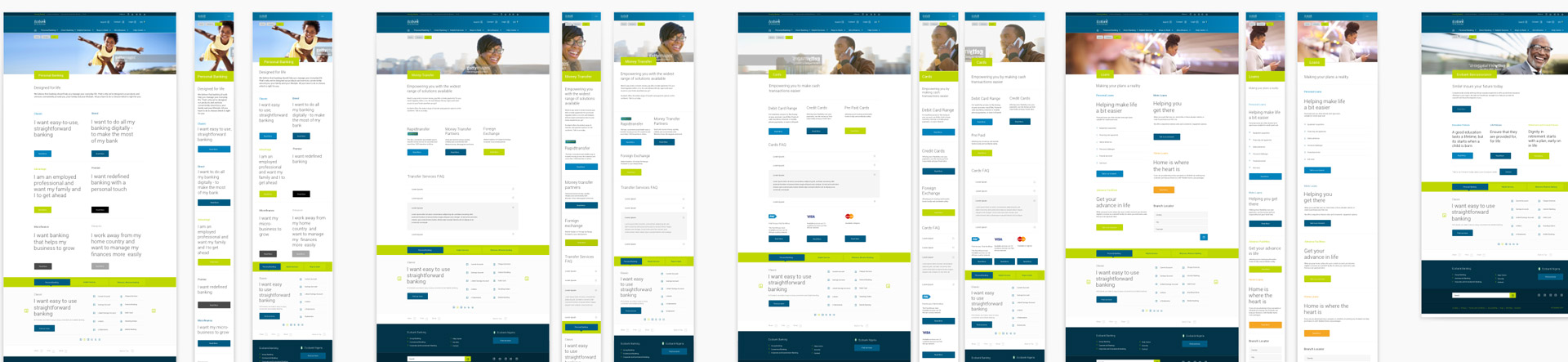

In Africa, a fast-growing number of people use banks for their financial management and online banks are substantial touchpoints. For Pan Africa Ecobank, I supported the redesign and service creation of their online presence, introducing user centred research and analysis.

Working for London based BrandComms next to the designers in the digital team I took care of branding and persona lifecycle integration with online and offline product profiles, which focused on the customer – service provider relationship. My work included delivering insights for the content relevance of different customer segments, first-time users and less educated users, to overcome usability and confidence hurdles. The bank, in the end, is not merely about money operation. Instead, it provides lifelong values.

Project backgrounds & objectives

As banking digitalisation is quite on demand, Ecobank appointed BrandComms for refurbishing their long-existing website, intending to re-imagine it, starting from the homepage out to create a richly informative, user-friendly experience responding to different devices and usage.

Process

Customer analysis

Dive into user activities and behaviours

UI strategy

Outline UI strategies for different customer segmentations

Information architecture & wireframe

Build information architecture, templates and prototypes

User testing & Design iteration

Run usability testing for next step design

Customer analysis

Dive into user activities and behaviours

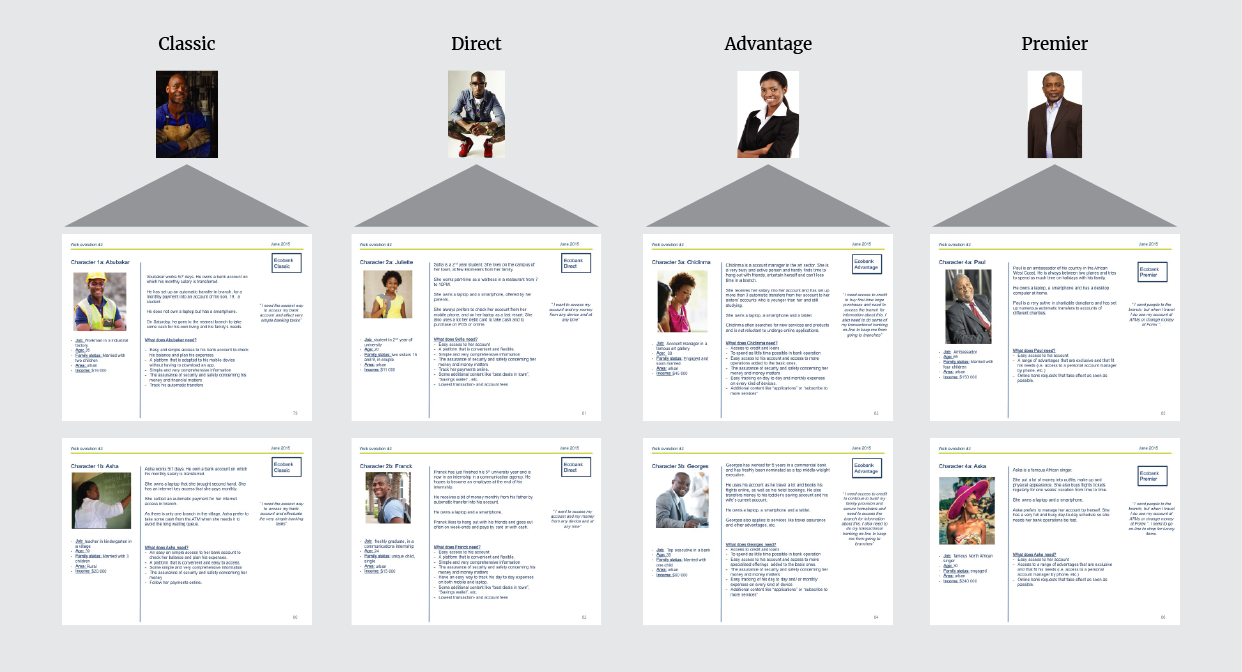

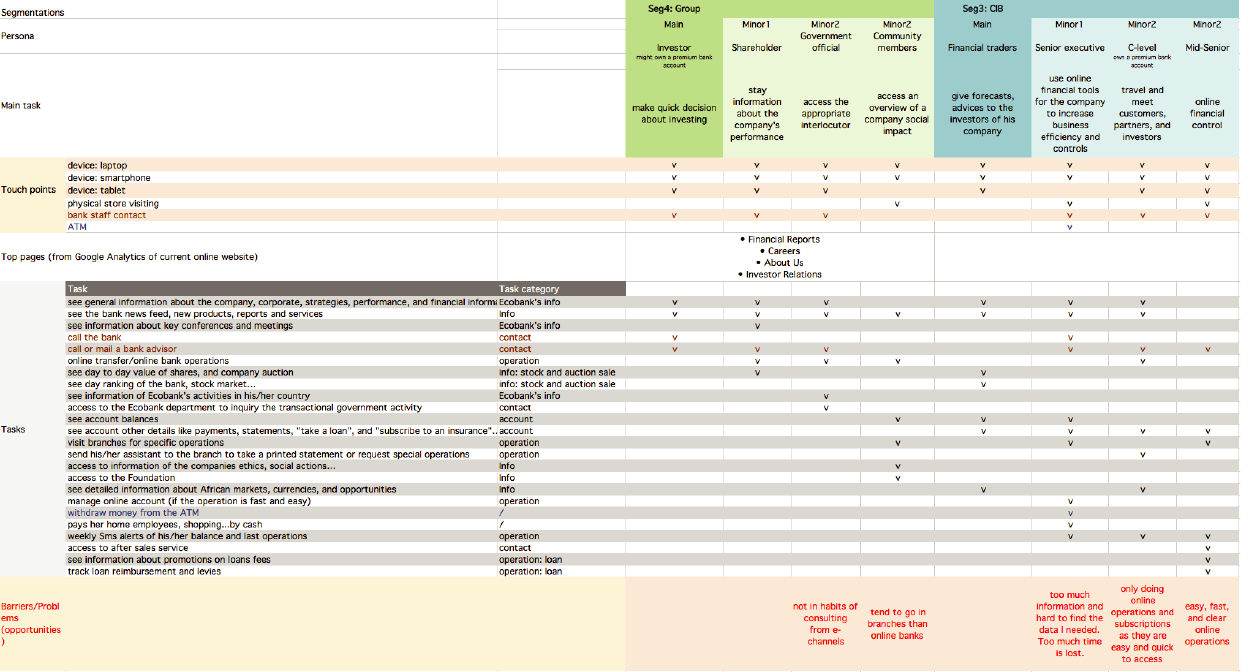

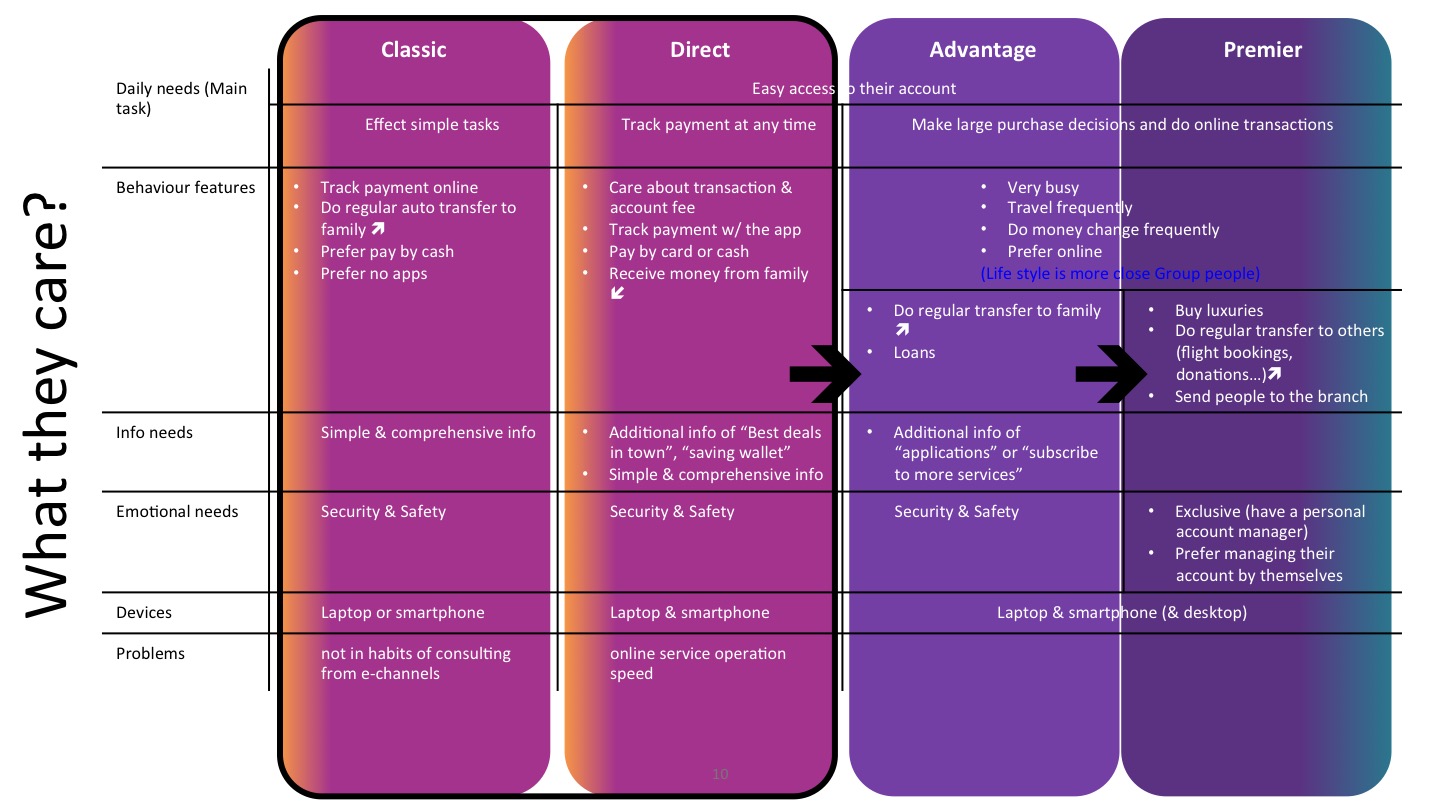

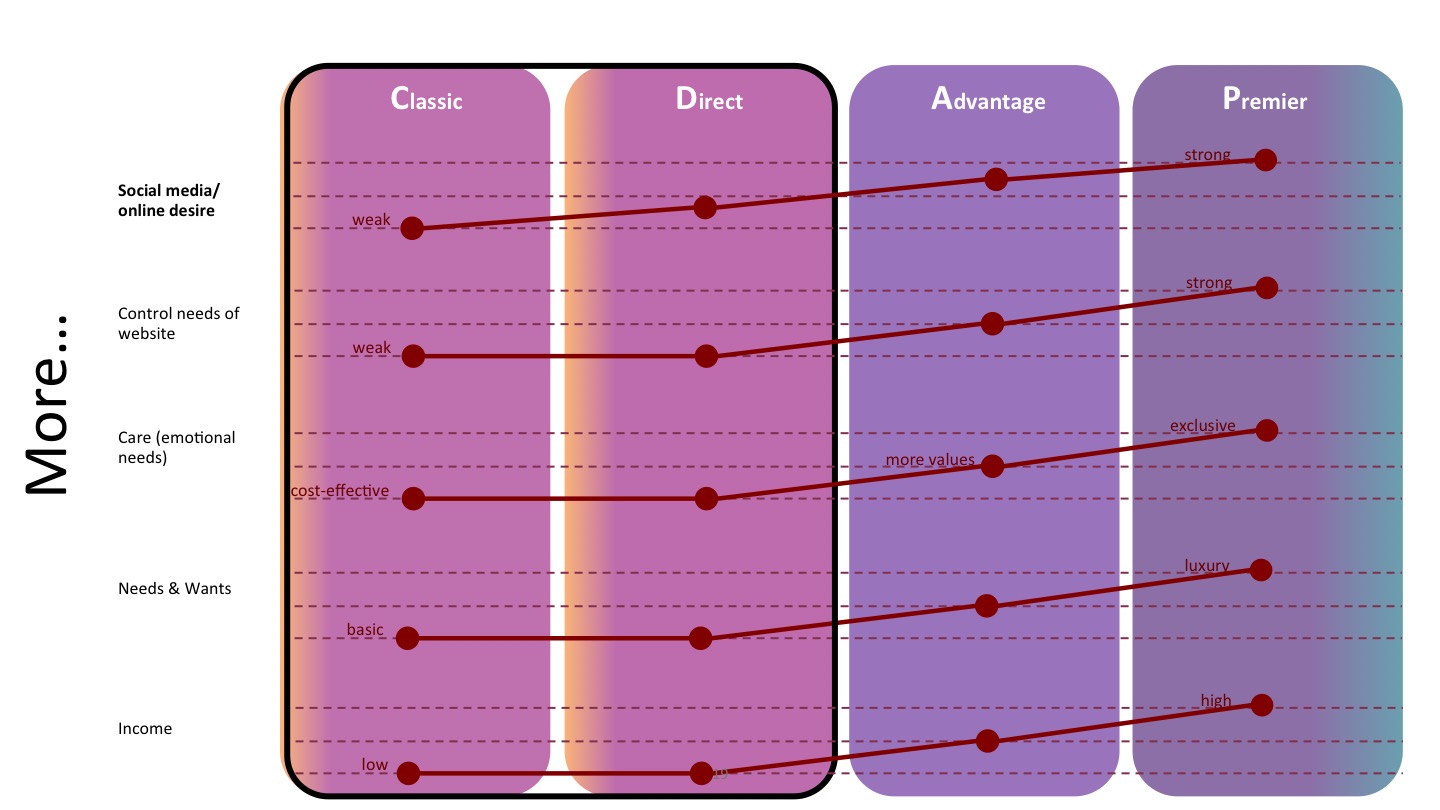

Coupled with client feedback, surveys, data of Google Analytics and customer profiles summarised by the strategists, I narrowed down all of the data into four personas, which reflected main target users through customer profiling and persona matrix analysis.

UI strategy

Outline UI strategies for different customer segmentations

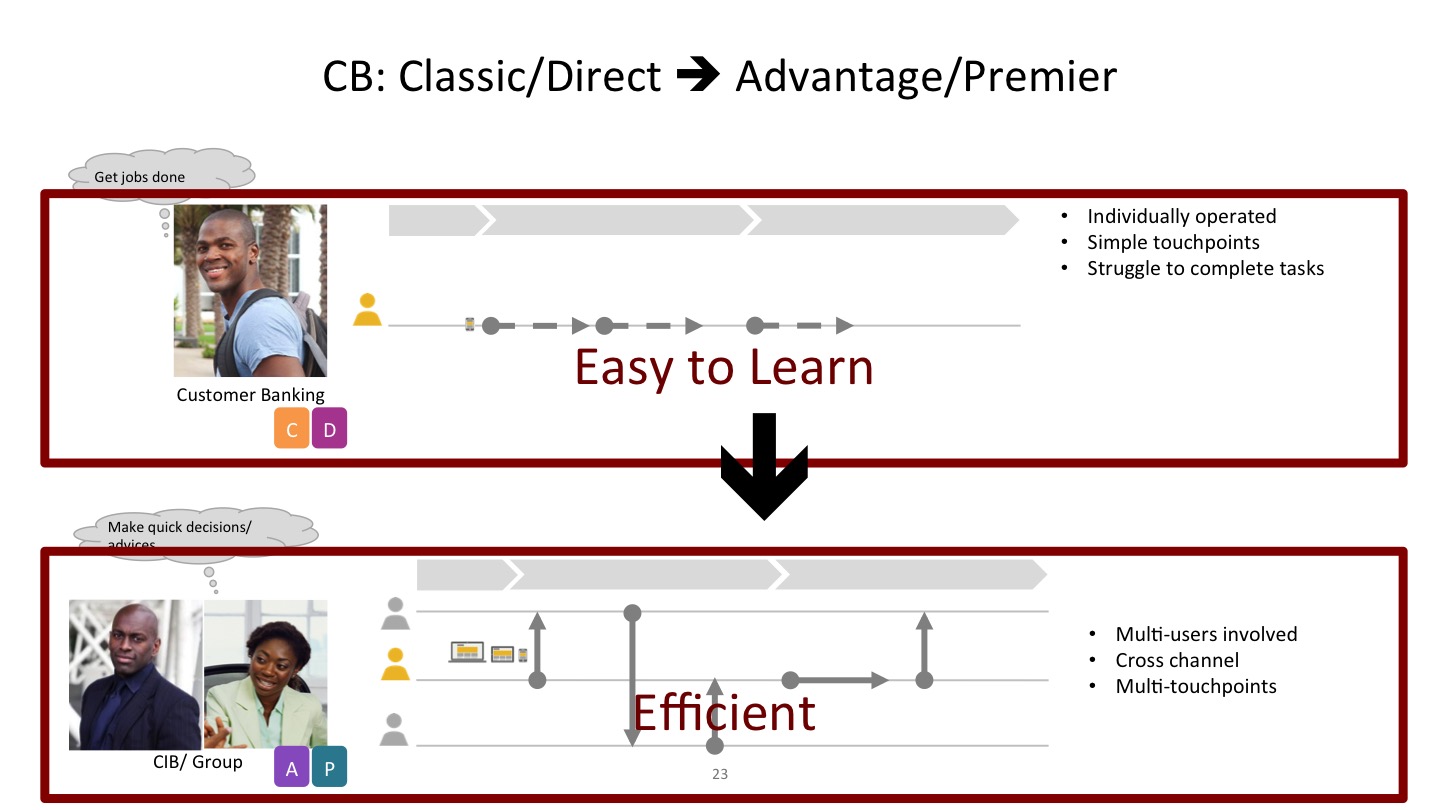

As each persona had clear characteristics, intents and activities, plus shared similar behaviour patterns, I looked into all these factors through user journey creation. I also proposed adopting the concept of journey transfer, meaning that linking different levels of accounts to users’ life stages— a strategy for scaling up business along with user goals. In the meantime, a variety of worldwide bank website benchmarks were conducted to grasp ideal design ideas. Based on these, UI design directions were addressed.

Information architecture & wireframe

Build information architecture, templates and prototypes

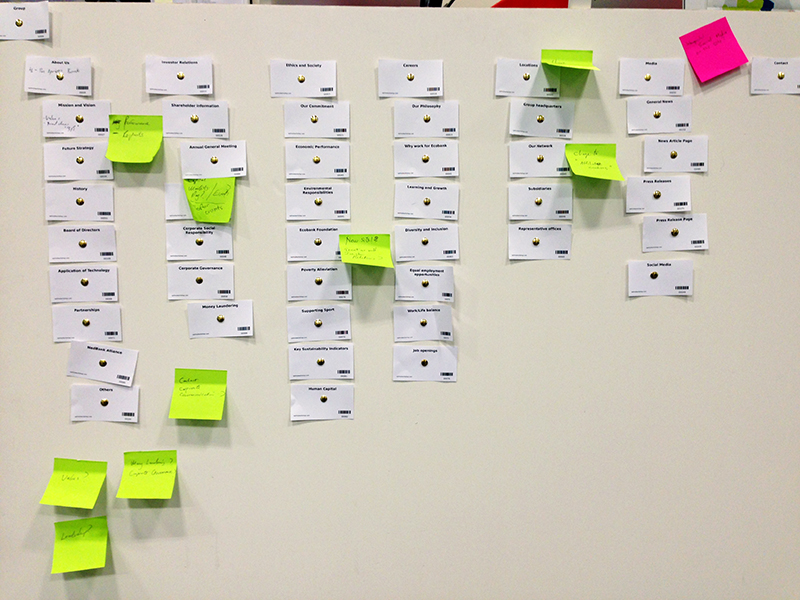

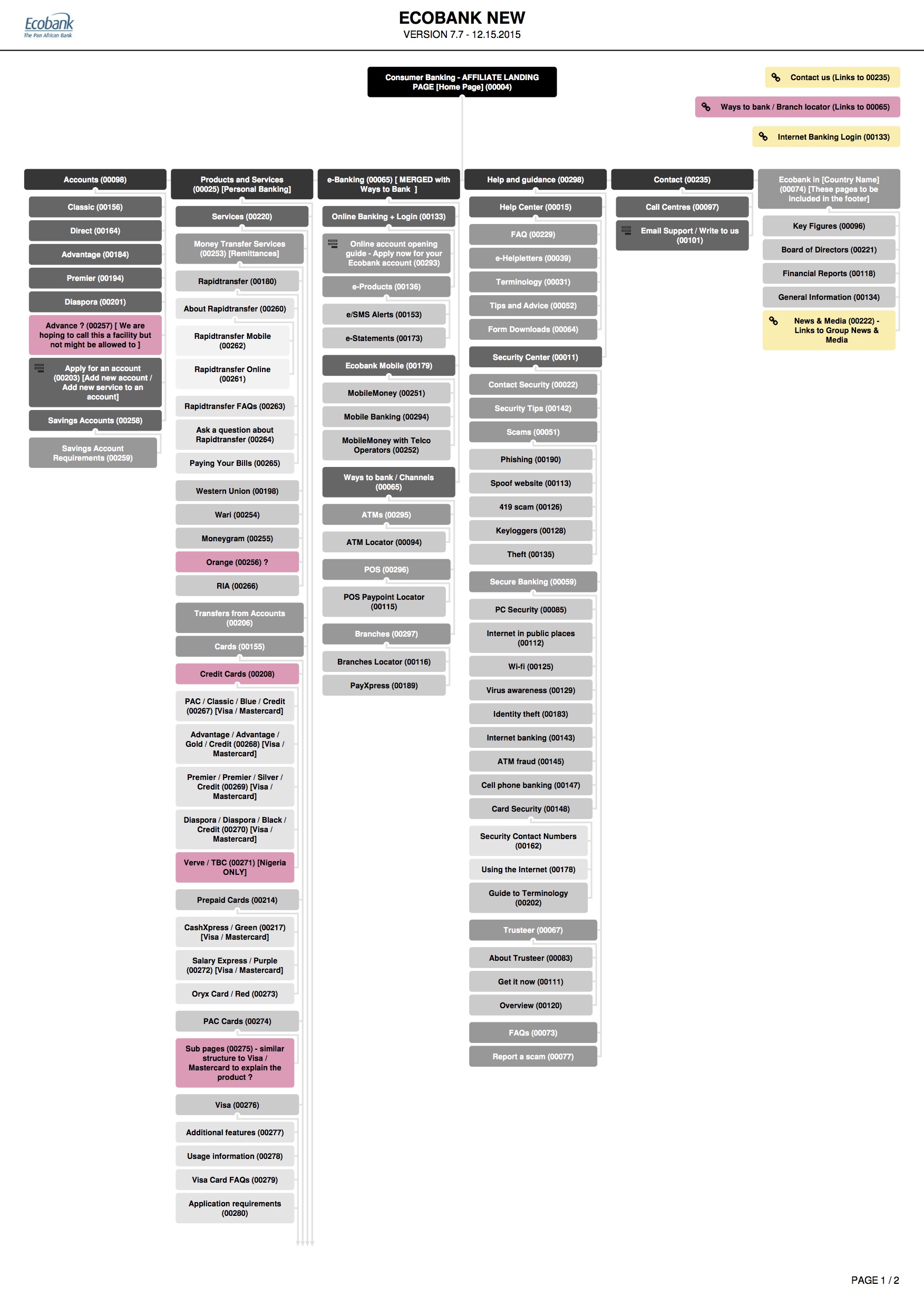

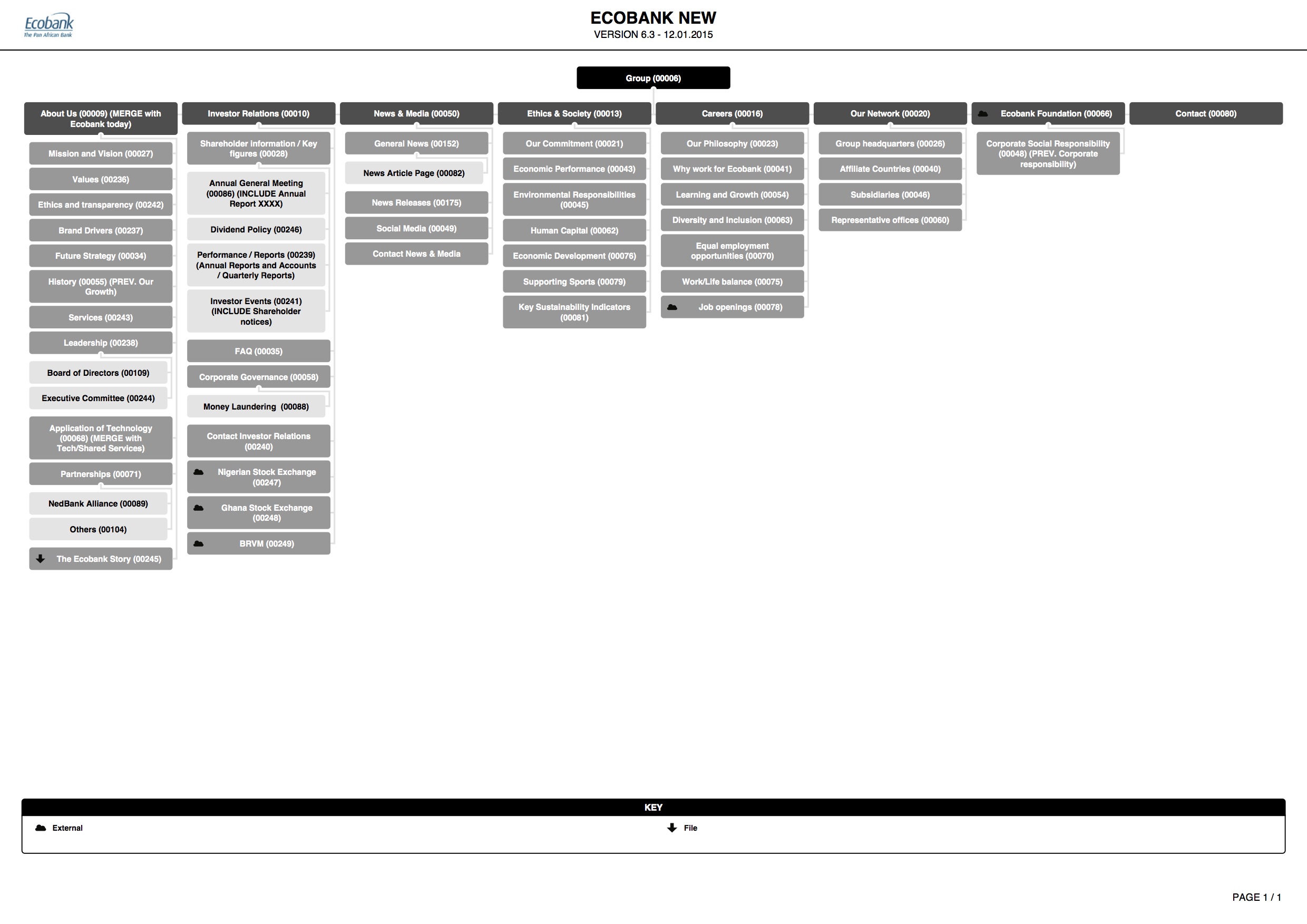

With the outcomes of the previous stages, we updated the function backlog and then built the information architecture by conducting card sorting within the team, as well as with stakeholders. The result was turned into a functional map of the website for desktops, tablets and mobiles.

Thereafter, through working closely together with two graphic designers, we carried out the UI layout guidelines and behaviour-based module templates such as homepage, news and articles for the following wireframe design.

User testing & Design iteration

We run agile, so once the first target user’s wireframes were carried out, we tested the design with users. I scripted down the tasks and set up the scenarios and then invited users to operate the prototypes run on InVision, along with screens and sound records done by QuickTime Player. After that, examining the design expectations across different users I created an analysis that was turned into clear directions of design refinement.

Footage sample of the user test:

Results & Impacts

Create a channel between their strategy and design teams

In my role as a user researcher I helped BrandComms to link the strategy and digital teams and thus improved their co-working and value creation. The strategy reports can now be transferred directly into directions for the digital product design, while before the reports were solely sent as research backup to the managerial level.

As the strategy director told me:

“Now I eventually know how my strategy analysis can help our digital product design, it is not just shown to the team managers for review.”

New awarding winning website

The website development started as soon as the first version was validated and refined from the testing. The new website was released in 2016 Q1. It won the 2016 Web Jurist Award (powered by Phillips Consulting) for the Banking Sector in Nigeria, being considered as an example of “detailed evaluation of aesthetics, technical aspects, website content, user experience and performance”.